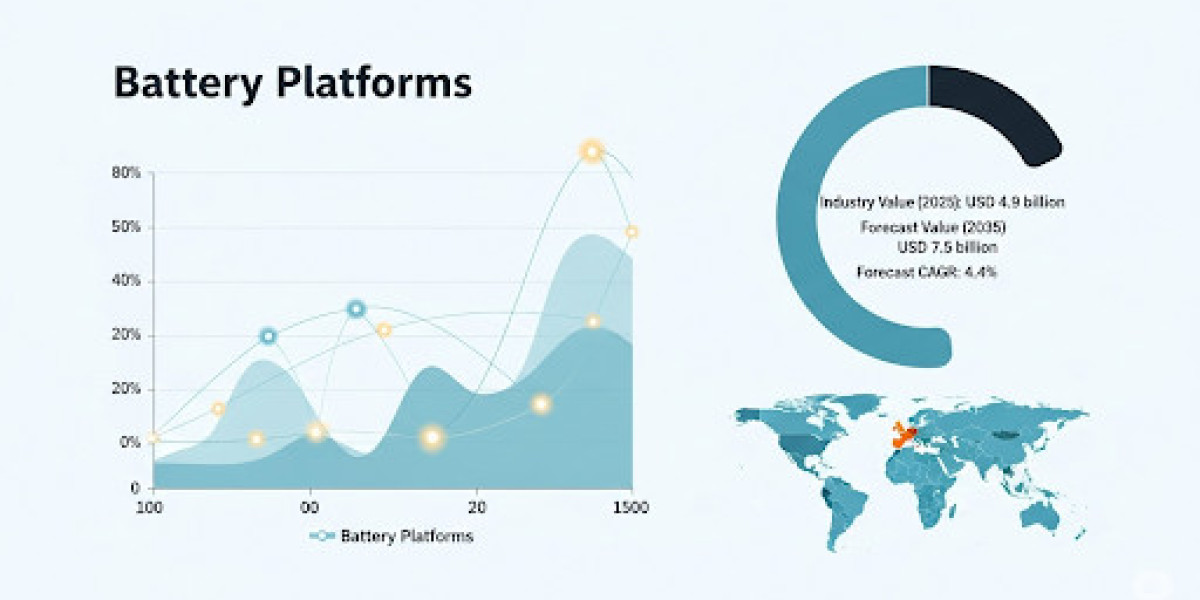

The global Battery Platforms Market is on track for significant expansion, rising from USD 4.9 billion in 2025 to USD 7.5 billion by 2035. This reflects an added value of USD 2.6 billion, representing 53.5% cumulative growth over the forecast period. Backed by electrification initiatives in automotive, industrial, and energy storage sectors, battery platforms are quickly becoming a core enabler for scalable, cost-efficient system design.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-23265

Between 2025 and 2030, the market is expected to expand from USD 4.8 billion to USD 6.0 billion, adding USD 1.2 billion in incremental revenue. This surge will be shaped by the rapid adoption of modular battery systems across EVs, outdoor equipment, grid-scale storage, and consumer electronics. Manufacturers are increasingly prioritizing platform-based architectures—enabling streamlined production, greater cross-product interoperability, and accelerated new-model development.

A second growth wave between 2030 and 2035 is forecasted to generate an additional USD 1.5 billion as solid-state battery innovations, second-life applications, and circularity-driven design mandates reshape the competitive environment. The shift toward universal platform standards is supporting broader integration across automotive, aerospace, defense, and industrial sectors.

From 2020 to 2025, the market expanded from USD 4.0 billion to USD 4.9 billion, reflecting strong OEM-led momentum. Rapid evolution in battery chemistries such as NMC and LFP, diverse form factors, and standardized battery management systems (BMS) accelerated the industry’s pivot from custom pack designs to scalable, modular architectures. Successful platform strategies—including GM’s Ultium, VW’s MEB, and BYD’s Blade battery—demonstrated how unified designs reduce capital expenditure and improve time-to-market across product lines.

Why the Market Is Growing

Growth is attributed to three long-term structural shifts:

- Electrification across mobility and industrial applications

EV adoption, commercial fleet conversion, and high-density storage needs are driving demand for batteries that support diverse performance requirements through a shared architecture. - Rising need for scalable, flexible systems

Modular battery platforms reduce engineering costs and simplify maintenance. OEMs benefit from the ability to deploy a single architecture across multiple product variants. - Regulatory push for lifecycle transparency and sustainability

New rules promoting recycling, battery passports, and second-life integration are influencing platform designs that are easier to disassemble, trace, and repurpose.

Market Segmentation Highlights

- By Battery Type:

Lithium-ion dominates with 55% share in 2025, projected to grow at 5.4% CAGR due to its energy density and broad application in EVs, power tools, and electronics. - By Platform Type:

Tool battery platforms hold 70% share in 2025, driven by OEM-standardized ecosystems that enable interchangeability across power tools and outdoor equipment. - By Application:

Power tools and outdoor equipment represent 35% of market demand, supported by the shift from corded to cordless systems and growing preference for high-capacity swappable batteries.

Key Trends Influencing Growth

- Multi-vehicle integration:

A single battery platform serving sedans, SUVs, and light commercial vehicles is enabling shared R&D investment and faster production cycles. - Thermal management innovation:

Liquid cooling systems, advanced thermal interface materials, and real-time diagnostic layers are central to evolving safety requirements. - Circularity and second-life adoption:

Platforms are increasingly designed for recycling, repurposing, and integration into stationary storage projects—extending battery lifecycle value.

Regional Outlook

Europe’s battery platforms market will expand from USD 1.16 billion (2025) to USD 1.86 billion (2035) at 4.8% CAGR, driven by state-supported gigafactories, EV mandates, and shared platform strategies across OEM alliances. Germany remains the region’s growth anchor, while France, the UK, Italy, and Spain see accelerated adoption across public transport and passenger EV programs.

The United States continues expanding platform-based architectures across SUVs, pickups, and commercial fleets, supported by subsidies and domestic cell-sourcing initiatives. Meanwhile, Japan and South Korea maintain strong positions in tool-specific and advanced lithium-ion platform development.

Emerging markets such as Brazil and Australia are accelerating their EV supply chain integration, localizing battery module production, and expanding platform deployment for commercial fleets and off-grid energy systems.

Competitive Landscape

Competition is intensifying as Tesla, LG Energy Solution, CATL, Panasonic, Bosch Power Tools, BYD, and Samsung SDI invest in automation, digital twin manufacturing, silicon-anode chemistries, and high-density lithium-ion platforms. Recent milestones include Enovix’s AI-1™ silicon-anode platform, Honeywell’s gigafactory automation software suite, and DOE-backed domestic pilot lines for advanced lithium-ion cells.